Ecosystem driven economy

Blockchain / Distributed Ledger Technology (DLT)

Definition of Blockchain and Distributed Ledger Technology (DLT)

A blockchain or, more generally, distributed ledger technology (DLT) is a

- (Potentially peer-to-peer) protocol for a

- Cryptographically secured

- (Public or private) distributed ledger of

- Simple or generalized transactions (the generalized transactions typically called smart contracts).

DLTs which validate, store, and link transactions in blocks are called blockchains, but there are others (like IOTA) which store transactions in different formats (e.g., directed acyclic graphs).

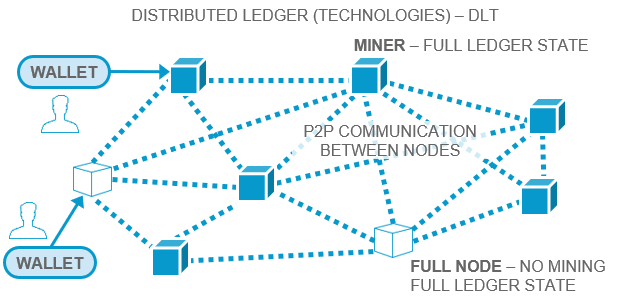

Active participants, who are storing and maintaining the ledger are typically called «nodes» (with «miners» creating new blocks in many, but not all DLTs). End users very often use secondary software such as a «wallet» to interface with a «node» in order to retrieve or send transactions to and from the DLT network.

Some DLTs (like Bitcoin) only support moving (crypto-)tokens (e.g., Bitcoins) as transactions. Others, like Ethereum or IOTA, support the execution of complex programs on top of the ledger, the so-called «smart contracts».

Blockchains or DLTs are is suitable for many-party interactions in an untrusted environment where all parties have to reach consensus on a common global state of affairs without any natural or trusted intermediary.

Technology Evaluation

Blockchain technologies including DLTs are a wonderful example how an ingenious combination of several (known) technologies was able (in 2009) to create a wholly new approach to a very old (database) problem: namely, how to reliably replicate state in an unreliable or even adversarial environment.

The generalization of the notions of (i) crypto currencies (such as Bitcoin) to wholly generic crypto assets and (ii) of simple crypto token-moving transactions into smart contracts executing between untrusting parties goes beyond naïve database paradigms such as stored procedures.

Today, many different DLTs exist, each optimizing different sets of nonfunctional requirements. Furthermore, the so-called “blockchain trilemma” of simultaneously providing scalability, security, and decentralization, has not been fully solved today. (Bitcoin providing ca. 5 transactions per second, Ethereum ca. 10 tps).

Market - Current Adoption

Blockchain and DLTs are still a considerably overhyped technology looking for business problems they solve better than any existing alternative (e.g., a central SaaS).

Despite many claims to the contrary, almost no real productive use cases exist except crypto exchanges. Many (if not all) reported “productive” solutions refer to very small pilot or test deployments of economically irrelevant size and impact to any business.

Market - Outlook

DLTs can become a real game changer due to their innate properties (such as decentralization, trustlessness, smart contracts, crypto assets incl. currencies) in certain competitive niches once they have been identified.

Governmental-defined crypto currencies (e.g., a “digital Euro”), assets (e.g., shares in companies) or other tokens (e.g., decentralized identifiers, DIDs) will become available in 3-8 years increasing possibilities and pressure to digitize businesses and processes.