Hybrid & multi-cloud infrastructure

5G Edge

Definition of 5G Edge Computing

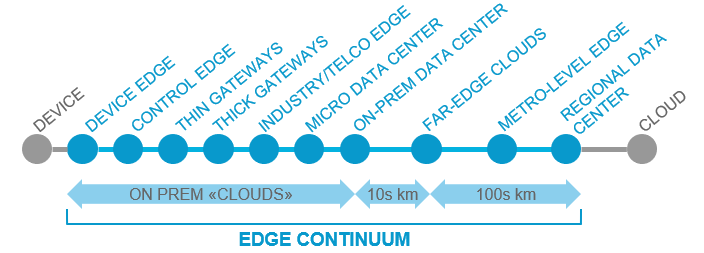

Edge computing refers to any form of moving computing resources (incl. applications) from the cloud closer to devices or assets. Depending on device proximity, there are different types of ‘edges’, all of which are forming the ‘edge continuum’. Telcos and communication service providers (CSPs) often call this ‘multi-access edge computing’ (MEC); cf. the ETSI MEC standards.

5G natively supports and complements (but does not implement) edge computing with (traffic) routing, exposing edge services thru 5G functions (Application Function (AF), User Plane Function (UPF), Network Exposure Function (NEF), and others), mobility, local data network access, charging, and quality of service (QoS).

When deciding between cloud or edge computing, the following six technical factors drive the outcome towards edge computing — with the first three factors (in bold) being the most relevant drivers:

- Latency

- Bandwidth

- Security

- Privacy

- Proximity to (larger) processing power (e.g., CPUs)

- Network virtualization (especially brought about by 5G)

Technology Evaluation

Due to the highly specific non-functional requirements fulfilled only by edge computing, this deployment option will — in general — always be a part of enterprise IT besides cloud services.

Note that 5G does neither standardize nor directly need edge computing but provides a complementary set of features enabling or strongly supporting edge computing for:

- Hosting and running 5G functions themselves (only relevant to public or private 5G network operators),

- Interfacing 5G components (including 5G-capable mobile phones) with applications running on the edge.

It will be exciting to watch how the competition between classical edge providers (such as Software AG), hyperscalers, 5G operators, and potential new entrants (like very large system integrators) will play out.

Market - Current Adoption

With the exception of pilot or proof of concept (PoC) commercial offerings of Amazon’s AWS Wavelength (Vodafone and Verizon) and a proprietary ‘Edge in a Box’ service (Deutsche Telekom), telcos do not seem to have even pilot or trial offerings of MEC (multi-access edge computing).

A large proportion of telcos is participating in one of the two global MEC initiatives (GSMA “Operator Platform” and 5G Future Forum) for MEC interoperability, but their actual commercial MEC offering is not detectable. It is well worth noting that the two hyperscalers Amazon (AWS Wavelength) and Microsoft (Azure Edge Zones and – the outcome still to be seen – their acquisition of Affirmed Networks) are already investing and ramping up their 5G edge offerings.

Market - Outlook

Despite attractive use cases ranging from autonomous driving, industrial IoT and VR/AR (virtual/augmented reality) to smart homes, the overall lack of 5G offerings, both in terms of core network infrastructure and the availability of affordable 5G end user equipment, has and will continue to delay MEC adoption considerably. Here, rollout of 5G user equipment and infrastructure will increase demand for edge capabilities in the mid-term (2-5 years) beyond current market dynamics with crucial dependency on the viability of edge use cases.

It remains to be seen how customers decide between edge offerings of the hyperscalers (promising hybrid interoperability between edge and their clouds) and telco edge offerings (e.g., based on ETSI MEC).